A Generational Opportunity in a $248B Market

Investor Relations

Delivering 70x superior pathogen reduction in a $248B market, Illumisoft combines a validated IP moat with an attractive valuation gap against legacy competitors to redefine global biological safety.

Investment Highlights

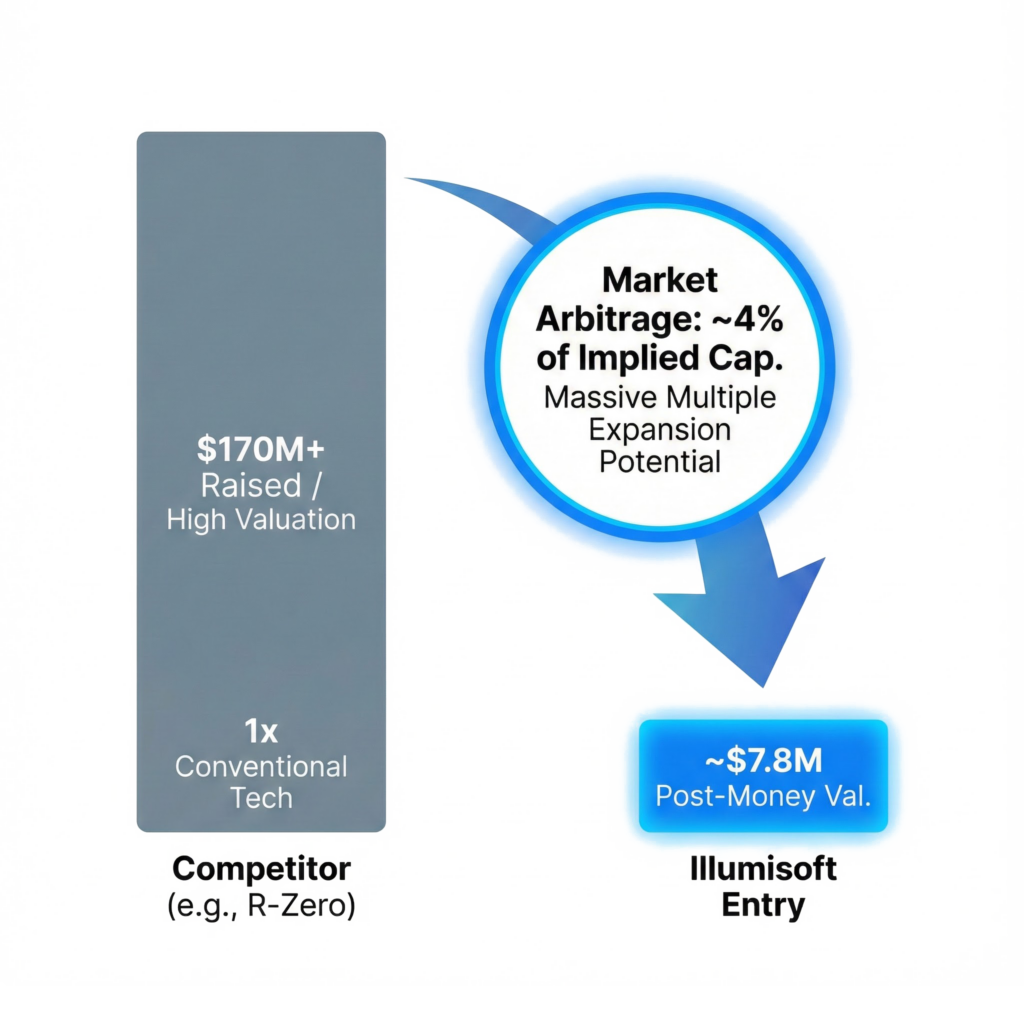

1. The Market Arbitrage (Valuation & Upside)

Illumisoft offers a compelling entry point with a ~$7.8M USD post-money valuation.

The Competitor Gap: Compare this to key competitor R-Zero, who raised $170M USD (Series C) using conventional UV-C technology.

- The Value Play: Illumisoft offers superior, next-generation technology (70x efficiency) at a valuation ~4% of R-Zero’s implied cap, offering investors massive multiple expansion potential upon commercial scaling.

Explosive Sector Growth: We are positioning to capture share in the Global Infection Control market, surging from $248B (2024) to $473B (2034).

- Target Segment: The Hospital-Acquired Infection (HAI) control subset is a $38.5B immediate opportunity growing at a 9.9% CAGR due to increasing regulatory pressure on hospitals to reduce infection rates.

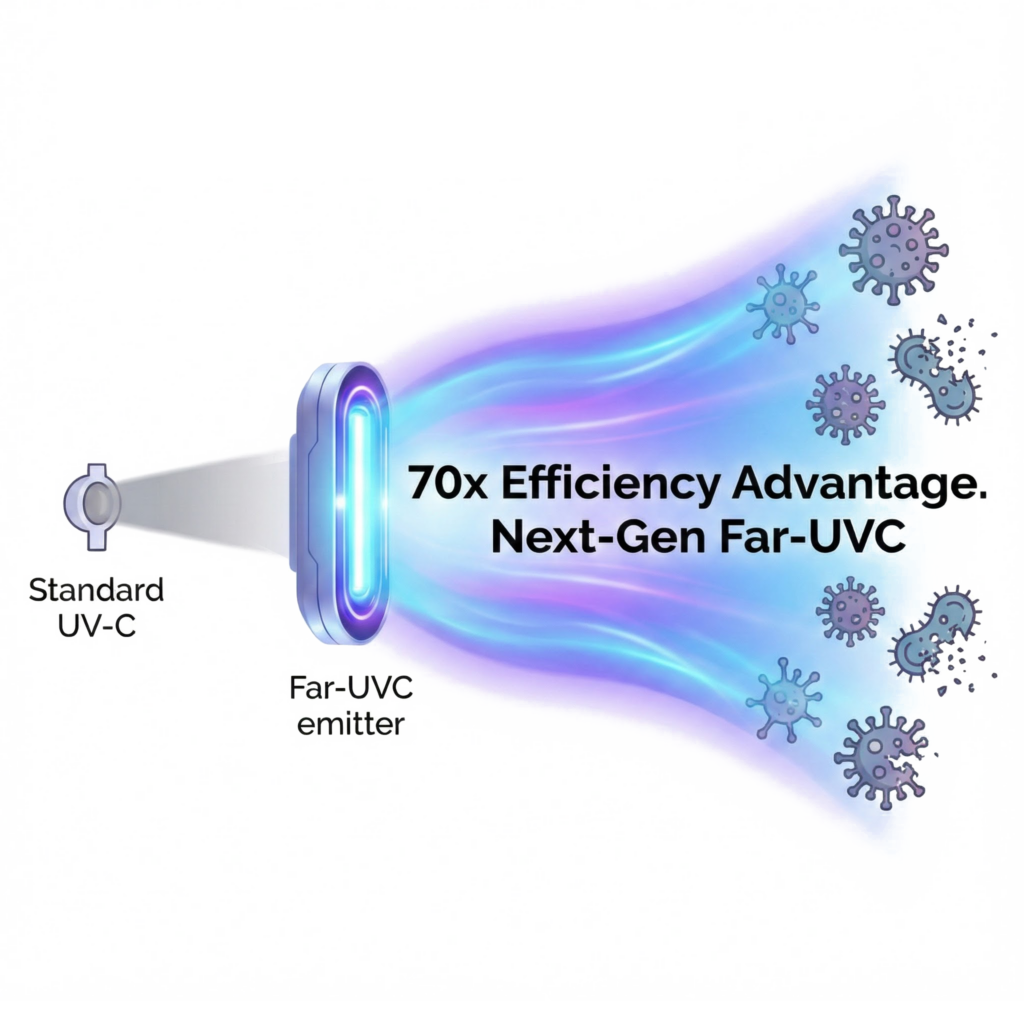

2. The Technological Moat (IP & Validation)

- Dominant Intellectual Property: Our portfolio is defended by 19+ patents covering device architecture, airflow dynamics, and safety mechanisms.

- A "Quantum Leap" in Performance: Unlike standard UV-C, our breakthrough Far-UVC technology is scientifically validated to be 70x more powerful in pathogen reduction while remaining safe for human occupancy.

- Clinical Validation: Validated by the University of Leeds—a global leader in aerobiology—as the "best performing UV device tested to date," achieving a 99.7% reduction in airborne pathogens (confirmed efficacy against SARS-CoV-2, Influenza, and drug-resistant bacteria).

3. The Execution Engine (Business Model & Regulatory)

Regulatory First-Mover Advantage: We hold the First Health Canada Registration for an upper-room GUV device. This is not just a certification; it is a competitive barrier to entry that streamlines our path to FDA 510(k) and CE Marking.

High-Margin Scalability:

- 60% Gross Margin Target: Achieved through optimized manufacturing and premium pricing power for clinical-grade hardware.

- Capital-Light Expansion: Our licensing model allows for rapid global deployment without the heavy capex drag of building owned manufacturing facilities abroad.

4. Path to Liquidity (Roadmap & Catalysts)

Phase 1 Commercialization: Immediate focus on the 6,500 hospital network in North America, leveraging Canadian regulatory wins as a “quality stamp” for US adoption.

12-18 Month Catalysts:

- Capital Markets: Planned TSX-V Listing to unlock liquidity and institutional capital.

- Revenue Events: Securing Tier-1 Hospital Contracts.

- Tech Expansion: FDA 510(k) filing and the unveiling of the SaniLux prototype (expanding the TAM into commercial/retail spaces).

The “Fire Suppression” Vision: We are not just selling devices; we are establishing Far-UVC as critical building infrastructure. Just as fire suppression systems became mandatory in the 20th century, Illumisoft technology is positioning to become the mandatory standard for biological safety in the 21st.